Discover a better way

to invest in property

All the returns of residential property

without the stress of being a landlord

AS SEEN ON

Strong returns i

Access a property growth linked return from a diversified portfolio of vetted Australian residential real estate assets.

Reduced outgoingsii

Enjoy the growth upside without the usual land-tax, letting fees, maintenance, and mortgage costs.

Socially responsible

More than property growth, you’re investing in essential workers, so they can own a home close to work.

Hear from our investorsiii

VFFF views HOPE Housing as a welcome addition to the impact investment portfolio and values the innovative, yet considered, approach they have taken in the development of their model. The impact of the model on the lives of essential workers participating in the scheme is clear.

Jenny Wheatley, CEO

Vincent Fairfax Family Foundation

HOPE Housing is an investment that not only offers financial returns but also has altruistic elements. HOPE appealed to me becauseit helps people achieve something that might otherwise be out of their reach.

Tim Norton

Entrepreneur and Property Investor

HOPE has a good, solid return over a ten-year period, and I think the whole thesis around providing housing for essential workers and front-line workers is really important – they give a lot to our community, and to be able to provide a solution to their housing needs is pretty special.

Nicola Paramor

Paramor Family Foundation

Chatleigh Foundation invests in HOPE Housing because it’s an investment in our communities, families, and core values. It is a way to create meaningful, lasting impact by supporting essential workers—the backbone of our communities.

Joe Ware, Managing Director

Chatleigh Foundation

How it worksiv

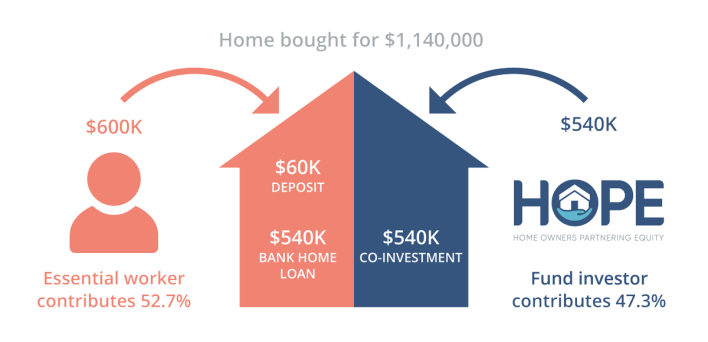

The HOPE Fund gives investors a new way to access the stable and solid returns of the Australian residential property market, while enabling home ownership.

We achieve this through our unique shared equity model, which puts home ownership within reach of our dedicated essential workforce community and simplifies and de-risks property investment for investors.

Why invest ?

Diversification

Gain exposure to a portfolio of vetted residential assets in high-growth metropolitan areas, through one investment.

Hassle free

No land-tax, property management fees or out-of-pocket property expenses.

$100K starting investment

Invest just $100K to access a diversified portfolio of owner-occupied, family homes.

Fund performance information

Portfolio Growth

| 12 months to Jun ‘ 24 |

|---|---|

Property Assets in Portfolio⁽ᴬ⁾ | 12.2% |

CoreLogic Index | 12 months to Jun ‘ 24 |

|---|---|

All Dwellings Sydney⁽ᴮ⁾ | 6.3% |

Social Return on Investment | 12 months to Dec ‘23 |

|---|---|

Social Value Created⁽ᶜ⁾ | 13% |

Measurable impact

HOPE’s social impact is measured using established models and actual homeowner data. Our impact reporting focuses on the effect homeownership has on several critical areas, including:

Rated as investment grade

"This rating affirms HOPE's position as a leader in social impact investing, providing investors with access to capital growth and diversification benefits in the residential property market"

Angela Ashton

Founder and Director

Evergreen Consultants

How to invest

Confirm you meet the sophisticated investor test.

Review Fund Disclosure documents.

Complete an online application to apply for units in the Fund.

Benefits for homeowners

Low deposit

Homeowners can enter the scheme with a minimum of 2.5% deposit.

Manageable mortgage

HOPE and Police Bank ensure mortgage servicing is within 30% of household income when essential workers enter the scheme.

Close to work

Homes are located within 30 minutes commute of an essential worker’s workplace, reducing commute times and stabilising workforces in critical urban regions.

Frequently asked questions

Making an investment

The HOPE Fund is open to any investor who meets the Wholesale or Sophisticated investor definition. Our minimum investment is AU$100K.

You can invest directly with the fund via our online application. Soon you will be able to invest via select platforms. For more information on what platforms will be available, contact [email protected].

Financial returns and distributions

The return profile in Australian residential property is characterised by low yields and high capital growth. HOPE provides exposure to the capital growth of a portfolio of vetted residential property assets, owned and occupied by essential workers. By removing the typical costs associated with investing in residential property, and by selecting quality assets, HOPE aims to maximise an investors exposure to this capital growth, enhancing returns.

No – the Fund pays none of these typical fees, as the homeowner is responsible for all costs related to the property. The homeowner is also on title and no land tax is payable by investors in the HOPE Fund.

Unit holders may be able to transfer their units to third parties, subject to terms outlined in the PPM.

HOPE may provide capital for all types of housing except for off the plan developments. All approvals are subject to HOPE’s full pre-purchase due diligence conducted on every asset, this includes an onsite valuation, which sets the purchase price limit for our co-investment.

Social returns

HOPE has developed a social return methodology in partnership with industry experts, including The Centre for Social Impact and Think Impact. In the 12 months to December 2023 the Fund delivered a social return of 13.5% p.a.

Are you ready to invest?

Start your online application today to invest in more than real estate.

Our partners

Disclaimer

The offer of units in the HOPE Housing Investment Trust (Fund) is available only to ‘wholesale clients’ within the meaning of that term under the Corporations Act 2001 (Cth). This page/document does not constitute an offer for units in the Fund. Prospective investors should refer to the Fund’s private placement memorandum for further information about the offer and the Fund. Past performance is not a reliable indicator of future performance. For more information about the Fund, please refer to our Investor Disclaimer on our website.

(i) HOPE refers to HOPE Housing Fund Management Limited.

(ii) HOPE offers an investment opportunity for sophisticated investors to access the Australian residential real estate market which has had 40+ years of historical growth rate of 7.89% according to BIS Oxford Economic property index. The HOPE Fund’s return may not correlate to the historical returns of the Australian residential real estate market.

(iii) An investment in HOPE Fund gets you access to a diversified portfolio of residential real estate. Homeowners are on title and required to maintain the home and all pay costs. HOPE has priority on all properties within the portfolio.

(A) Portfolio growth is determined by estimating market value of the properties within the Fund’s portfolio monthly, using CoreLogic IntelliVal (Automated Valuation Estimate) and PropTrack AVM. The change in total portfolio value is indexed from a base value of 100, established at the inception of the Fund’s portfolio, to account for the addition of new properties during the same period. The 12-month growth represents the cumulative growth over the prior four quarters. The portfolio growth information does not take into account liabilities or expenses of the Fund and therefore may not reflect overall Fund performance.

(B) This is the growth of residential real estate in the Sydney market and is sourced from the ‘CoreLogic Hedonic Home Index reports’ for ‘All Dwellings’ in the Sydney market. The detailed methodology can be found on the CoreLogic Australia website.

© Copyright 2024. RP Data Pty Ltd trading as CoreLogic Asia Pacific (CoreLogic) and its licensors are the sole and exclusive owners of all rights, title and interest (including intellectual property rights) subsisting in this publication, including any data, analytics, statistics and other information contained in this publication (Data) . All rights reserved.

(C) Social return on investment is determined by HOPE and is assessed by surveying HOPE homeowners and applying proxies, sourced from domestic and international academic studies, to calculate value creation using a methodology that adheres to Social Value International’s principles of social valuation. ‘The Principles of Social Value’ and the methodology is available on Social Value International’s website. Social return is measured annually by HOPE each December. For more information about the calculation of the social return, please contact HOPE.

~Evergreen Rating: ©Evergreen 2023. All Rights Reserved. (ABN 91 643 905 257) (‘Evergreen Ratings’) is Authorised Representative 001283552 of Evergreen Fund Managers Pty Ltd trading as Evergreen Consultants (ABN 75 602 703 202, AFSL 486275). The group of companies is known as ‘Evergreen’. Evergreen is authorised to provide general advice to wholesale clients only. Any advice provided is general advice only and does not consider the objectives, financial situation or particular needs of any particular person. It is not a recommendation to purchase, redeem or sell any particular product. Before making an investment decision the reader must read the relevant product offer document, consider their own financial circumstances or seek personal financial advice on its appropriateness for them.